Who we Serve

Registered Investment Advisors

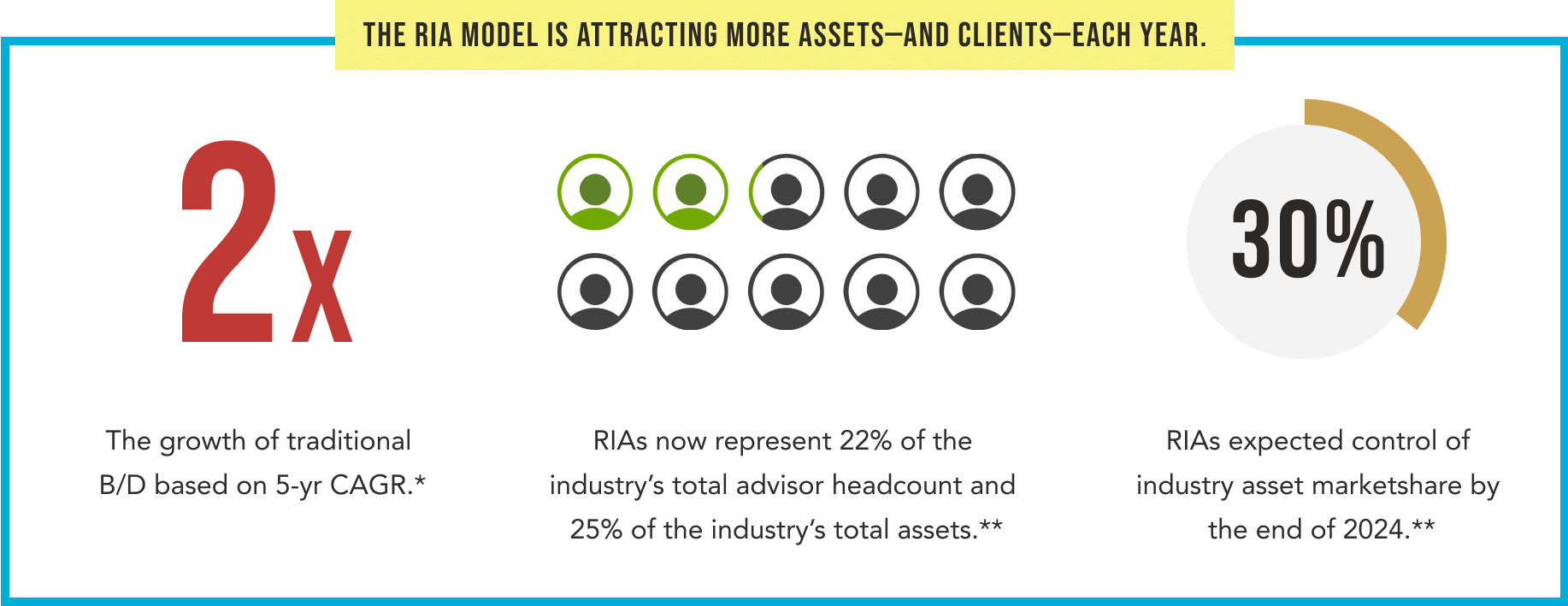

The Registered investment Advisor (RIA) model is blazing new paths through the traditional advisor landscape; offering new opportunities, resources, support and true independence.

* The Cerulli Report—U.S. Advisor Metrics 2020 – Exhibit 2.0, Advisor-Managed Assets, 2009-2019

** The Cerulli Report—U.S. Advisor Metrics 2020 – Exhibit 2.03 – Part 1, Overview of Advisor Channels, 2019

First Clearing is your guide to create the client experience you desire and the legacy you deserve.

When you work with First Clearing, you’re combining strength, scale and heritage with more than 30 years of providing custody services to RIAs and brokerage firms:

Lets Have a Conversation

Whether you’re looking to start an RIA or looking for a new custodian. First Clearing is here to help. Together, we’re redefining independence. If you’re ready to learn more or get the conversation started, reach out to us.

GIVE US A CALL TODAY1 Lending services accessed through Wells Fargo Clearing Services or its affiliates including securities based financing, residential mortgages, business financing and credit cards.

2 Securities based lending has special risks and is not appropriate for everyone. If the market value of a client s pledged securities declines below required levels, the client may be required to pay down his or her line of credit or pledge additional eligible securities in order to maintain it, or the lender may require the sale of some or all of the client s pledged securities. Wells Fargo Clearing Services, LLC will attempt to notify clients of maintenance calls but is not required to do so. Clients are not entitled to choose which securities in their accounts are sold. The sale of their pledged securities may cause clients to suffer adverse tax consequences. Clients should discuss the tax implications of pledging securities as collateral with their tax advisors. First Clearing and its affiliates are not tax or legal advisors. An increase in interest rates will affect the overall cost of borrowing. All securities and accounts are subject to eligibility requirements. Clients should read all line of credit documents carefully. The proceeds from securities based lines of credit may not be used to purchase additional securities, pay down margin, or for insurance products offered by Wells Fargo and any of its affiliates. Securities held in a retirement account cannot be used as collateral to obtain a loan. Securities purchased in the pledge account must meet collateral eligibility requirements.

3 Lending and other banking services available through Wells Fargo Clearing Services, LLC (NMLS UI 2234) are offered by banking and non banking subsidiaries of Wells Fargo & Company, including, but not limited to Wells Fargo Bank, N.A. (NMLSR ID 399801), Member FDIC, and Wells Fargo Home Mortgage, a division of Wells Fargo Bank, N.A. Certain restrictions apply. Programs, rates, terms, and conditions are subject to change without advance notice. Products are not available in all states. Wells Fargo Clearing Services, LLC is licensed by the Department of Business Oversight under the California Residential Mortgage Lending Act and the Arizona Department of Financial Institutions (NMLS ID 0906158). Wells Fargo Clearing Services, LLC, holds a residential mortgage broker license in Georgia and is licensed as a residential mortgage broker (license number MB2234) in Massachusetts.

![]()

4 Wells Fargo Private Bank offers products and services through Wells Fargo Bank, N.A. and its various affiliates and subsidiaries. Wells Fargo Bank, N.A. is a bank affiliate of Wells Fargo & Company.

5 Wells Fargo Investment Institute, Inc. (WFII) is a registered investment adviser and wholly owned subsidiary of Wells Fargo Bank, N.A., a bank affiliate of Wells Fargo & Company.

6 Adhesion Wealth Advisor Solutions, Inc. is a registered investment adviser and wholly owned subsidiary of Vestmark, Inc. and is not affiliated with Wells Fargo & Company.

7 TradePMR, Inc. is a privately held brokerage and custodian service provider for Registered Investment Advisors and is not affiliated with Wells Fargo & Company.